BHIM UPI, as you must be aware, is a digital payment system launched by the National Payments Corporation of India (NPCI) in 2016. It allows users to make instant money transfers to any bank account in India by simply using a virtual payment address or account number and IFSC code. It is built on top of the Immediate Payment Service (IMPS) and is based on the UPI platform.

It ditches the traditional method where users had to add extra information like bank acc number, IFSC code and account holder name and make use of UPI instead. But, today we are not here to discuss BHIM UPI as everyone’s aware of it: today, the topic of discussion is what to do if the BHIM UPI service is not working for you.

One of the key features of BHIM UPI, as mentioned above, is its simplicity and ease of use. Users can easily link their bank accounts to the BHIM UPI app and start making transactions without the need for any additional information like bank account numbers, IFSC codes, or net banking credentials. Additionally, BHIM UPI also allows for easy and secure transactions through the use of QR codes and biometric authentication.

BHIM UPI: Why was my transaction declined?

There are several reasons why a BHIM UPI transaction may be declined:

Insufficient funds: If the account from which the transaction is being made does not have enough funds, the transaction will be declined.

Incorrect details: If the virtual payment address, account number, or IFSC code provided is incorrect, the transaction will be declined.

Limit exceeded: Transactions have a daily limit for each account, if the limit is exceeded, the transaction will be declined.

Transaction blocked by the bank: Some banks may have blocked certain types of transactions or may have blocked the account due to suspicious activity.

Incorrect Pin: If the Pin provided is incorrect, the transaction will be declined

Error with the UPI server: Sometimes, there may be technical issues with the UPI server that can cause transactions to be declined.

Note: It is recommended to check the account balance and to make sure that all the details are correct before making a transaction. If the issue persists, it is advisable to contact your bank for further assistance.BHIM UPI: Pros and Cons

Pros

Easy to use and navigate

Instant money transfer

Secure transactions

Multi-language support

Multiple transactions options

Available for both Android and iOS users

Cons:

Only available in India

No cashback unlike its alternatives

Poor UI

BHIM UPI: How to link Credit Card?

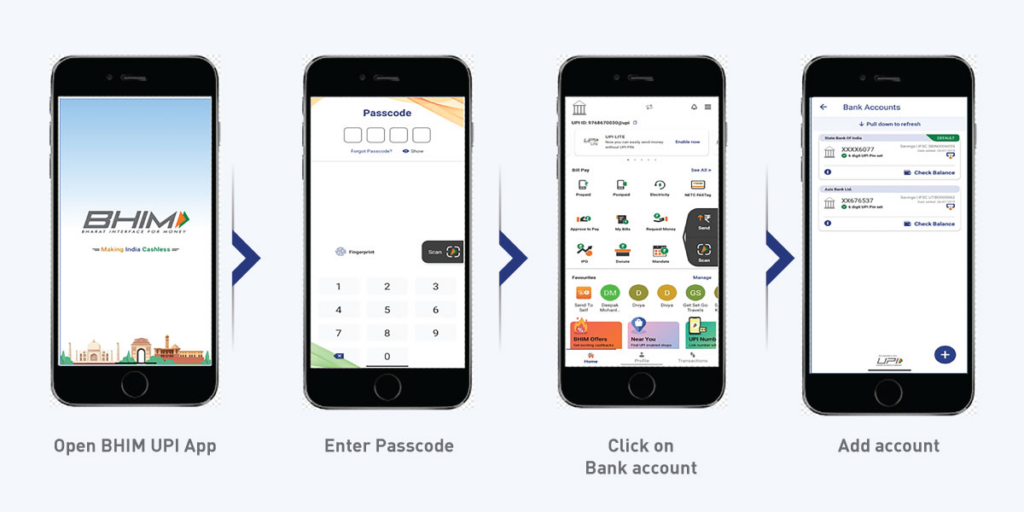

To link your RuPay credit card to BHIM UPI, you will need to follow these steps:

- Download and install the BHIM UPI app from the Google Play Store or Apple App Store.

- Open the BHIM UPI app and select the “Bank Account” option.

- Select your bank from the list of banks displayed.

- Enter your RuPay credit card details, including the card number, expiry date, and CVV code.

- Verify your card using the OTP sent to your registered mobile number.

- Set a UPI PIN for your credit card.

- Your RuPay credit card should now be linked to your BHIM UPI account.

- Once the card is linked, you can now use it to make transactions through the BHIM UPI app.

Also Read | The Complete Guide to Electronic Payments

Extra Tip: Users can avail cashback upto 10 per cent on each UPI transaction made through Rupay Credit Card. However, it requires the transaction to be above Rs 50 and the cap on cashback is Rs 100 per transaction and upto Rs 1000 per month.

BHIM UPI: What are the alternatives?

There are several alternatives to BHIM UPI that can be used for digital transactions in India, some of which include:

Google Pay: This is a digital wallet and online payment system developed by Google. It allows users to make payments using their mobile number and bank account.

PhonePe: This is a digital wallet and UPI-based payments app developed by Flipkart. It allows users to make payments, transfer money, and check bank balances using their mobile number and bank account.

Paytm: This is a digital wallet and e-commerce payment system. It allows users to make payments, transfer money, and check bank balances using their mobile number and bank account.

Amazon Pay: This is a digital wallet and online payment system developed by Amazon. It allows users to make payments, transfer money, and check bank balances using their mobile number and bank account.

WhatsApp Pay: This is a digital wallet and UPI-based payment feature developed by WhatsApp. It allows users to make payments and transfer money using their WhatsApp accounts.

CRED Pay: This is one of the best options for Credit card bill payments with its rewards and cashback. However, it has recently introduced CRED Pay UPI where you can earn rewards and cashback on each UPI transaction.

PayPal: This is a global e-commerce business allowing payments and money transfers to be made through the Internet.

Note: Banking apps like HDFC, Kotak, SBI, etc also allow users to make QR or UPI-enabled transactions via their platform. All these alternatives offer similar features and services as BHIM UPI and users can choose according to their preferences.

Summing It Up

BHIM UPI has added the ability to link Rupay credit cards, providing an additional payment option for users. However, if you are experiencing issues with BHIM UPI, there are other digital payment options available.

Alternatives such as Google Pay and PhonePe offer similar functionality and are widely accepted for digital transactions in India. These apps also offer various features such as cashback, digital wallet, and UPI-based payments. So, if you are facing any issues with BHIM UPI, you can consider these alternatives for a seamless digital transaction experience.