In recent years, there has been a significant shift in the way traders operate, with a growing number of them turning to online trading platforms to conduct their business. This shift has been driven by a number of factors, including the increased availability of technology, the convenience of trading from home or on the go, and the potential for higher profits.

This RevenueCenter review reveals one of the key drivers of this trend has been the emergence of online trading platforms that provide traders with access to a wide range of financial instruments and markets. These platforms offer traders a high degree of flexibility, allowing them to trade on their own terms and at their own pace. This is particularly appealing to traders who are looking to make a living from trading, as it allows them to manage their own schedules and work from anywhere in the world.

Another key factor driving the shift to online trading is the potential for higher profits. With the global financial markets constantly in flux, traders who are able to stay ahead of the curve can often make significant profits by buying and selling financial instruments at the right time. Online trading platforms offer traders access to real-time market data and analysis, which can help them make more informed trading decisions and increase their chances of success.

One notable platform that has contributed to this trend is The RevenueCenter. This platform has gained popularity among traders due to its user-friendly interface and its range of features, which include real-time market data, customizable charts, and a range of order types. The RevenueCenter review has highlighted the platform’s ability to cater to both novice and experienced traders.

In addition to these factors, online trading platforms also offer traders a high degree of security and transparency. These platforms are typically regulated by financial authorities and offer traders a range of tools and resources to help them manage their risk and protect their investments.

Overall, the shift to online trading is likely to continue in the coming years, as more traders recognize the benefits of this model. With platforms like The RevenueCenter offering traders access to a range of tools and resources, it is clear that the online trading landscape is becoming increasingly competitive, and traders.

The RevenueCenter Review: User Experience

If you’re looking for an online broker that provides an elite trading experience, look no further than The RevenueCenter. This online trading platform has gained a reputation thanks to its impressive range of features and user-friendly interface.

One of the key factors that set The RevenueCenter apart from other online brokers is its impressive range of tradable assets. Whether you’re interested in forex, stocks, commodities, or cryptocurrencies, you’ll find a wide variety of assets to choose from on this platform. This allows you to diversify your portfolio and take advantage of a range of different trading opportunities.

Another factor that makes The RevenueCenter a choice for traders is its sophisticated technology. The platform is designed to be easy to use, with an intuitive interface that makes it simple to navigate even for beginners. At the same time, the platform is packed with advanced features that allow experienced traders to take their trading game to the next level. These features include real-time market data, customizable charts, and a range of order types that allow you to execute trades with precision and speed.

The RevenueCenter review also highlights the platform’s great user experience. The platform is designed with the needs of traders in mind, and it shows in every aspect of its design. Wherever you’re using the platform, you’ll find that it is fast and easy to use.

Perhaps most importantly, The RevenueCenter is a broker that is committed to providing its users with a high degree of security and transparency. The platform is regulated by financial authorities, and it offers a range of tools and resources to help you manage your risk and protect your investments.

The RevenueCenter Review: Educational Resources

That’s why The RevenueCenter provides its users with a range of helpful educational resources to help them succeed in the markets. These resources include ebooks, a glossary of financial terms, an asset index, and an extensive FAQ section. The ebooks provided by The RevenueCenter cover a range of topics related to trading and investing. They cover topics such as technical analysis, risk management, and trading psychology, providing traders with valuable insights into the markets and how to succeed in them.

The glossary provided by The RevenueCenter is a good resource for traders who are new to the world of finance. This resource provides definitions for a wide range of financial terms, from basic concepts like stocks and bonds to more complex topics like options trading and derivatives. This resource is particularly helpful for traders who are just starting out and may be unfamiliar with some of the jargon used in the financial industry.

The asset index provided by The RevenueCenter is another valuable resource for traders. This index provides a comprehensive list of all the tradable assets available on the platform, including forex, stocks, commodities, and cryptocurrencies. Each asset is accompanied by detailed information about its characteristics and trading conditions, making it easy for traders to choose the right assets for their trading strategies.

Finally, the FAQ section provided by The RevenueCenter is a resource for traders who have questions or concerns about the platform or the markets in general. This section provides answers to a wide range of frequently asked questions, from basic questions about how to open an account to more advanced topics like margin trading and hedging strategies.

Overall, The RevenueCenter’s educational resources are a complement to its sophisticated trading platform. Whether you’re a beginner or an experienced trader, these resources can help you expand your knowledge of the markets and make more informed trading decisions. The RevenueCenter review highlights the value of these resources in helping traders succeed in the competitive world of online trading.

The RevenueCenter Review: Account Options

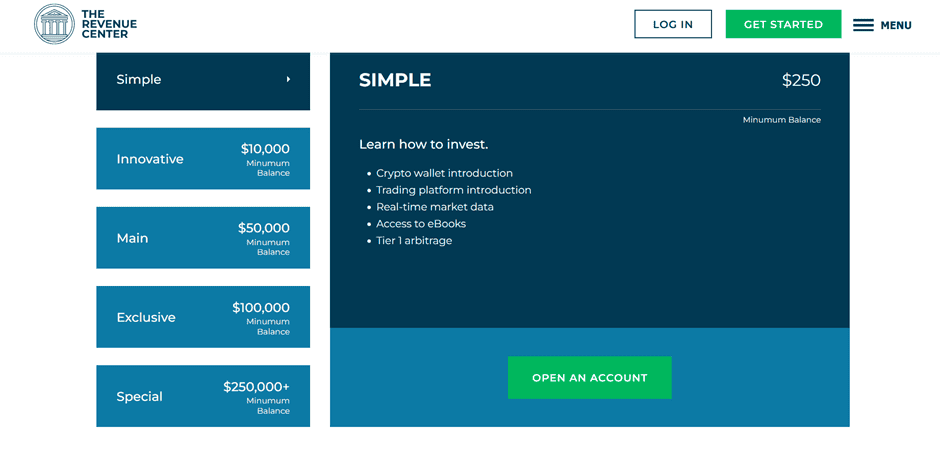

The RevenueCenter is an online broker that offers a range of account options to cater to the needs of traders of all levels. Whether you’re a beginner or an experienced professional, The RevenueCenter has an account that can meet your trading needs.

The Simple account is the most basic account option offered by The RevenueCenter. It requires a minimum balance of $250 and provides traders with access to a range of trading features, including a crypto wallet introduction, trading platform introduction, real-time market data, access to eBooks, and tier 1 arbitrage.

For traders who require more advanced features, The RevenueCenter also offers the Innovative account. This account requires a minimum balance of $10,000 and includes all the features of the Simple account, plus additional benefits such as a dedicated senior account manager, access to video lessons, flexible leverage up to 1:100, and spreads from 1.6 pips. It also includes tier 2 arbitrage, which is a more advanced trading strategy that can help traders increase their profits.

The Main account is the next step up from the Innovative account and requires a minimum balance of $50,000. It includes all the features of the Innovative account, plus additional benefits such as prioritized withdrawal level three, monthly analyst sessions, trade room analysis, flexible leverage up to 1:200, and spreads from 1.5 pips.

For traders who require even more advanced features, The RevenueCenter offers an Exclusive account. This account requires a minimum balance of $100,000 and includes all the features of the Main account, plus additional benefits such as prioritized withdrawal level two, access to advanced trading tools, weekly webinars, flexible leverage up to 1:300, and spreads from 0.5 pips.

Finally, The RevenueCenter also offers a Special account for traders who require the most advanced features. This account requires a minimum balance of $250,000+ and includes all the features of the Exclusive account, plus additional benefits such as prioritized withdrawal level one, access to one VIP event, daily webinars, powerful leverage up to 1:400, and spreads from 0.0 pips.

Overall, The RevenueCenter offers a range of account options to cater to the needs of traders of all levels. Each account option provides traders with access to a range of trading features, including real-time market data, access to eBooks, and powerful trading tools. The RevenueCenter review highlights the value of these account options in providing traders with the flexibility and features they need to succeed in the markets.

Take Away

In conclusion, the shift towards online trading platforms is a trend that is likely to continue in the coming years, with traders recognizing the benefits of this model. Platforms like The RevenueCenter are leading the way, providing users with a decent trading experience, a range of educational resources, and a variety of account options. As the online trading landscape becomes increasingly competitive, traders who are able to adapt and stay ahead of the curve will be best positioned to succeed.

Disclaimer: This article is not intended to be a recommendation. The author is not responsible for any resulting actions of the company during your trading experience. The information provided in this article may not be accurate or up-to-date. Any trading or financial decision you make is your sole responsibility, and you must not rely on any of the information provided here. We do not provide any warranties regarding the information in this website and are not responsible for any losses or damages incurred as a result of trading or investing.